Strategic Resilience: The New Bull Case for Western Mining Stocks

For forty years, the global mining sector has been the victim of a geopolitical "pump and dump" scheme. The cycle was brutal and predictable: a Western company would discover a deposit of cobalt or rare earths, raise capital, and break ground. Almost immediately, Chinese state-backed smelters would flood the market, crashing the spot price just enough to bankrupt the newcomer before snapping up the distressed assets for pennies on the dollar. It was efficient, ruthless, and effectively handed Beijing the keys to the 21st-century economy. But as of last week, the United States has officially decided to stop playing the victim and start playing the market.

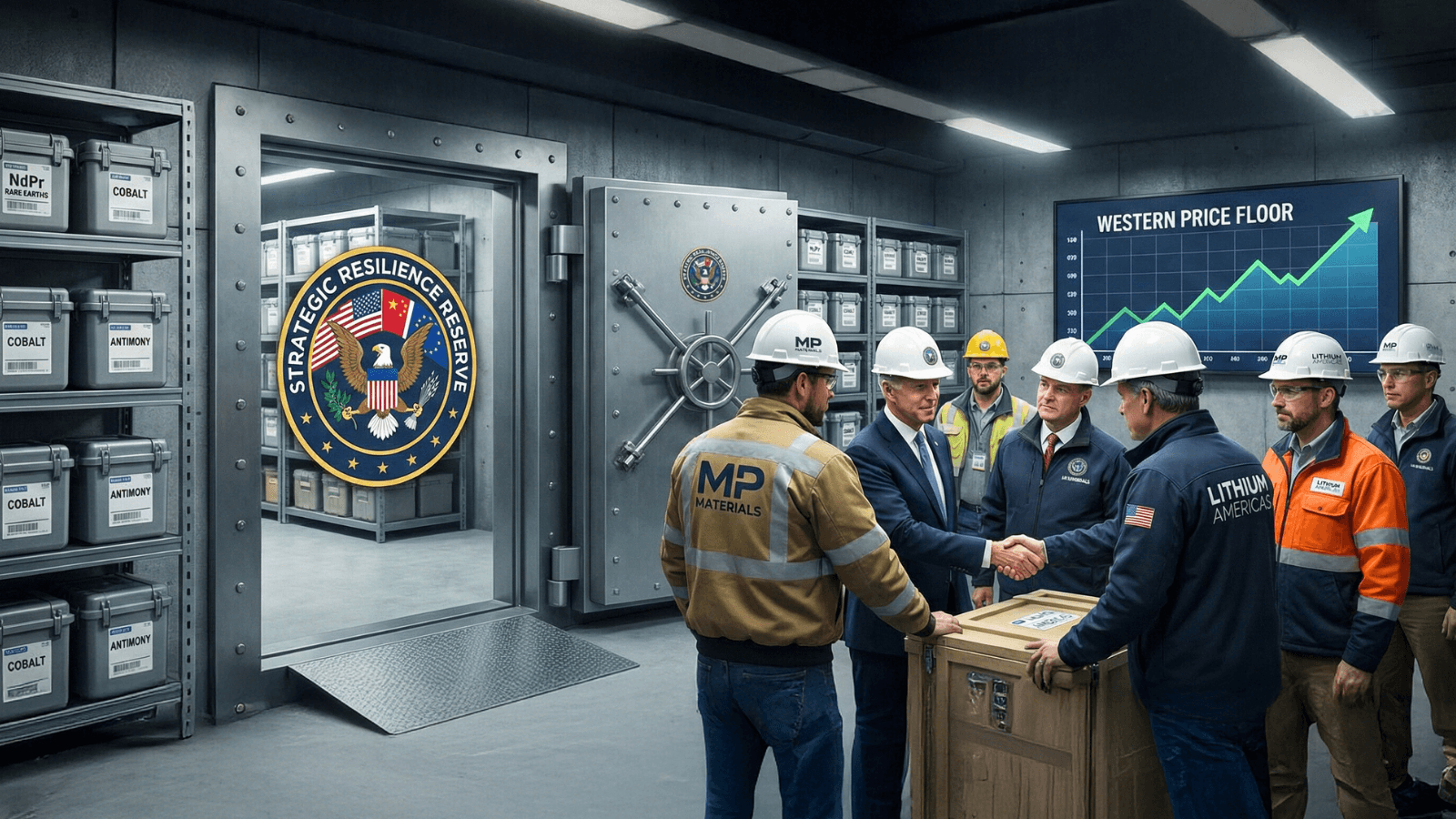

The introduction of the SECURE Minerals Act by Senators Jeanne Shaheen and Todd Young marks the end of passive American observation. Unveiled on January 15, the legislation creates the Strategic Resilience Reserve (SRR), a $2.5 billion revolving fund that operates less like a dusty warehouse of war supplies and more like a commodities trading desk backed by the U.S. Treasury. This isn't just a stockpile; it is a declaration of economic warfare against the "China Price."

At the heart of this strategy is a fundamental shift in how the Pentagon views value. For decades, defense contractors were forced to buy at the lowest commercial price, which invariably meant buying material refined in China. The SRR changes the calculus by authorizing a new federal board, modeled explicitly after the Federal Reserve, to purchase critical minerals at a premium from domestic and allied sources. While the Shanghai Metals Market might price neodymium at a level that guarantees bankruptcy for Western miners, the SRR has the authority to pay a "Western Price", potentially double the manipulated global rate, to ensure American mines stay open.

This creates a bifurcated global market: a cheap, high-risk price for conflict-laden minerals, and a premium, stable price for secure supply. The immediate beneficiaries are the few companies that have survived the volatility to establish domestic footholds. MP Materials (NYSE: MP), which operates the Mountain Pass mine in California, stands out as the only scaled producer of rare earths in the Western Hemisphere, making it a prime candidate for early contracts. Similarly, Perpetua Resources (NASDAQ: PPTA), which controls the Stibnite Gold Project in Idaho, is positioned to secure the domestic supply of antimony, a mineral essential for munitions and night vision that is currently 90% controlled by China and Russia.

Perhaps the most innovative feature of the bill is its invitation to the neighbors. The legislation is structured as an open club for allied nations, allowing countries like Canada and Australia to buy a seat at the table for a minimum buy-in of $100 million. This creates a sort of "NATO for rocks," pooling the purchasing power of the G7 to create a guaranteed demand shock. This is excellent news for Lithium Americas (NYSE: LAC), whose Thacker Pass project in Nevada is critical for the EV supply chain, and NioCorp Developments (NASDAQ: NB), which is developing the Elk Creek project in Nebraska and whose leadership has been vocal about the need for this exact type of market intervention.

Even smaller players and allied miners are finding themselves in the spotlight. Energy Fuels (NYSE: UUUU) is pivoting to become a critical mineral hub in Utah, while Canadian explorers like Electra Battery Materials (NASDAQ: ELBM) could see their cobalt refinery project effectively underwritten by this new allied purchasing block. By reinvesting profits from high-price sales back into the fund, the stockpile is designed to become self-sustaining. We have officially entered the age of critical minerals, and for the first time in history, the West is willing to pay the cover charge.

What did you think of this article?

Let the author know your thoughts

Investment Disclaimer

The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or professional advice. You may lose all of your money when investing. All investments carry substantial risk, including the potential for complete loss of principal. Past performance does not guarantee future results. You must conduct your own research and due diligence, including independently verifying all facts, numbers, and details provided in this article. Please consult with a qualified financial advisor before making any investment decisions.