The Most Mispriced AI Data Center in North America? Look Here

When most people see Galaxy Digital (GLXY), they see crypto. Wild price swings, Bitcoin connections, regulatory news… the usual things that make big investors avoid the stock.

That's just the surface. Here's what they're missing.

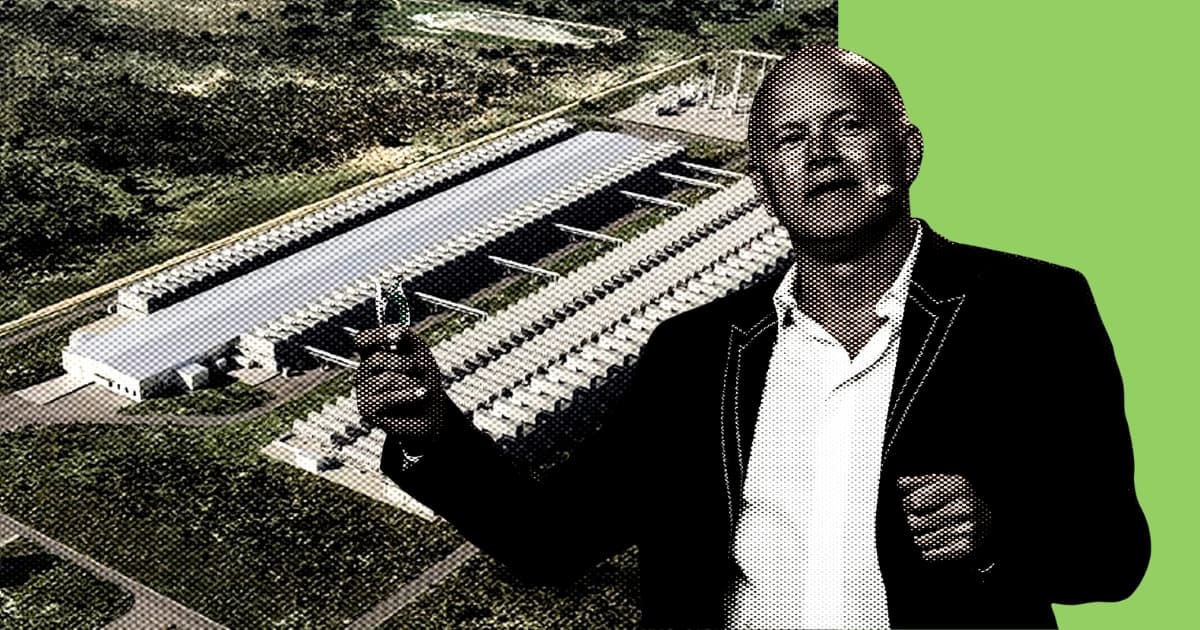

Hidden inside that crypto-labeled stock sits one a valuable AI infrastructure plays: a data center campus called Helios that Galaxy bought from Argo Blockchain in December 2022 for $65 million.

Subscriber Only Content

This article is for Hardwired subscribers only.

Signing Up Is Free And Gets You:

- Access to all subscriber-only content

- Join the community of readers

- Get notified of new articles

Free to Subscribe, Unsubscribe Anytime