Vizsla Silver vs. Apollo Silver: The Ferrari and the Freight Train

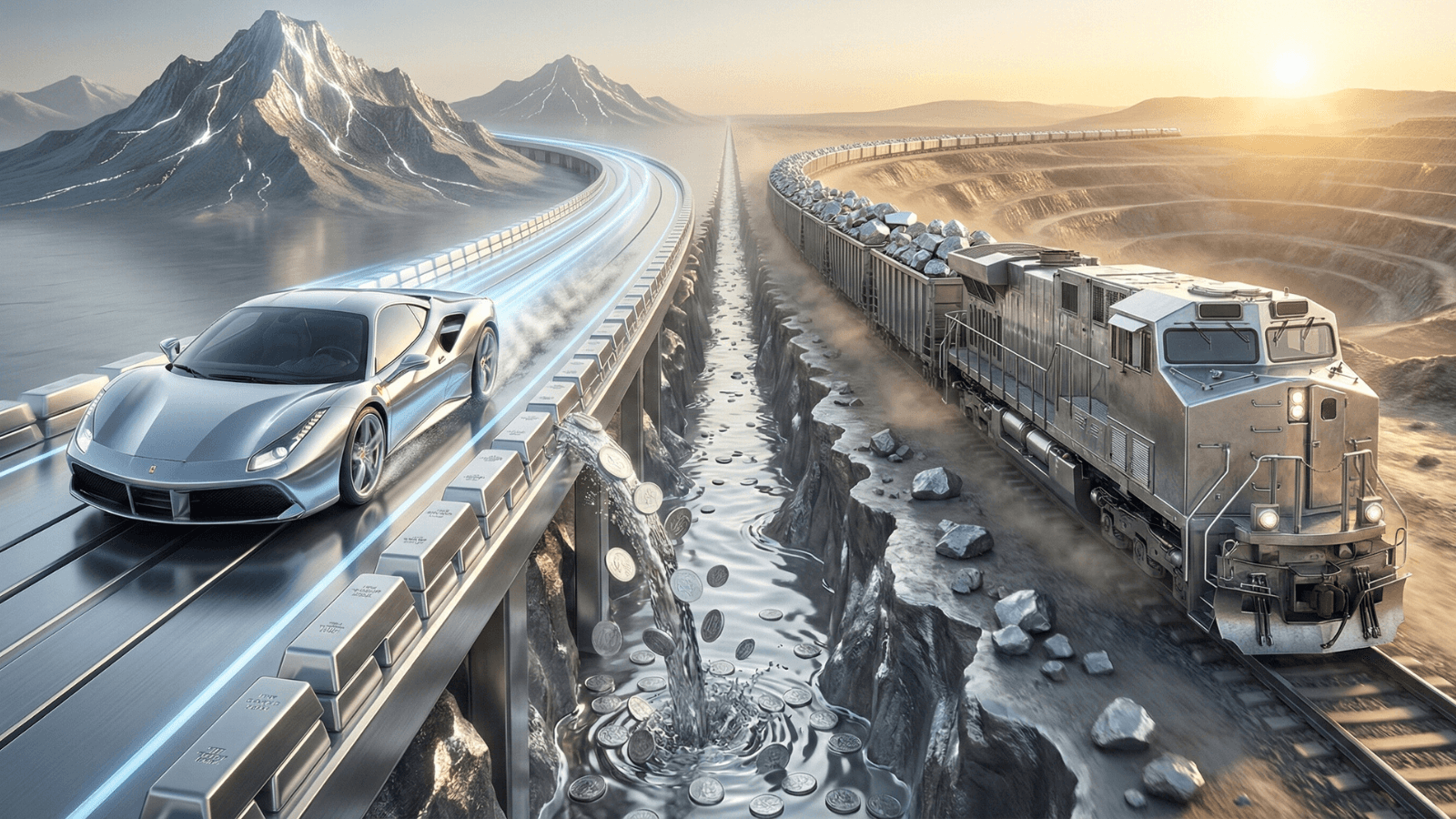

If you have been watching the silver market lately, you know the metal has finally decided to wake up and choose violence against the shorts. But for equity investors, this rising tide has revealed two very different vehicles for playing the breakout. It’s no longer just a question of buying "silver stocks"; it’s a choice between two distinct engineering philosophies: the Ferrari and the Freight Train.

Vizsla Silver (TSX: VZLA | NYSE: VZLA) is the Ferrari, sleek, high-grade, and built for speed, racing toward production with premium economics. Apollo Silver (TSX-V: APGO | OTCQB: APGOF) is the Freight Train, massive, industrial, and carrying a payload so heavy that once it gains momentum, it becomes an unstoppable force of leverage.

These two companies effectively bookend the risk-reward spectrum for 2026. One is a sprinter ready to cut the ribbon on a mine; the other is a bulk-tonnage heavyweight sitting on a strategic fortune in the United States.

The "Ferrari": Vizsla Silver

Let’s start with the one everyone is talking about. Vizsla Silver has effectively graduated from "explorer" to "developer elite." Their November 2025 Feasibility Study for the Panuco Project in Sinaloa, Mexico, dropped numbers that frankly look like typos. An after-tax NPV (5%) of US$1.8 billion and an Internal Rate of Return (IRR) of 111% are stats you rarely see outside of the tech sector.

What makes Vizsla the "Ferrari" of this race is the speed and the grade. They are looking at producing over 17 million silver-equivalent ounces annually, with a payback period of just seven months. That is not a mining ramp-up; that is an ATM machine coming online. With over US$450 million in the bank following their massive financing packages last year, the "funding risk" overhang that plagues 99% of juniors is gone. They are fully funded, permits are pending, and they are eyeing a construction start in the second half of this year.

However, you pay for that certainty. Vizsla trades at a premium because it offers immediate gratification and high margins. The market has priced in a lot of success, meaning the "easy money" has been made, and the stock now moves on execution and silver price beta.

The "Freight Train": Apollo Silver

If Vizsla is the sleek sports car, Apollo Silver is the massive freight train sitting in the station, fully loaded and waiting for the green light. Situated in San Bernardino County, California, their Calico Project is the antithesis of Panuco: it isn’t about high-grade veins; it’s about massive scale.

Apollo’s October 2025 Resource Update solidified what many suspected, this is one of the largest undeveloped silver endowments in the USA. We are talking about 125 million ounces of Measured and Indicated silver at the Waterloo deposit alone, plus another 57 million Inferred ounces at Langtry. But the kicker isn't just the silver; it’s the "Critical Minerals" designation. The update revealed significant Barite and Zinc credits, which fundamentally changes the conversation from "just a silver mine" to a domestic industrial supply chain asset.

The market, however, is still sleeping on this one. Apollo trades at a fraction of Vizsla’s valuation per ounce. Why? Because California permitting scares people more than Mexican cartels, and bulk tonnage projects require higher silver prices to really sing. But here is the wit in the tragedy: Eric Sprott and Jupiter Asset Management didn’t seem scared when they dumped $25 million into Apollo in December. They understand that in a bull market, leverage is everything. If silver moves $5, Vizsla makes great money, but Apollo’s economics transform exponentially.

The Verdict

Investors are left with a choice of philosophy. You buy Vizsla Silver if you want the safety of high grades, a funded treasury, and a team that is about to pour metal. It is the defensive, "get rich steadily" play.

You buy Apollo Silver if you believe we are in the early innings of a silver super-cycle. It is an unloved, undervalued asset in a Tier-1 jurisdiction that provides massive torque to the silver price. It’s the "swing for the fences" play for those who think the market is wrong about American permitting timelines.

In 2026, you probably want to date the Ferrari, but you might want to marry the Freight Train.

IMPORTANT UPDATE: January 29, 2026

Since we published this analysis on Wednesday 28th January 2026, the situation regarding Vizsla Silver (VZLA) has shifted from a story of economics to one of human concern.

As reported by CBC News, a group of 10 individuals were abducted from the Panuco project site in Sinaloa. This is a distressing development, and our thoughts are first and foremost with the workers, their families, and the entire Vizsla team as they navigate this crisis.

Market Context: While the safety of the personnel is the priority, the markets have reacted sharply to the uncertainty. Vizsla shares saw a significant 16.3% drop as investors weighed the impact of suspended operations and the heightened security risks in the region.

In contrast, Apollo Silver (APGO) saw a more moderate decline of 8.2%, likely moving in sympathy with the broader silver sector volatility. This tragic event serves as a sobering reminder that "The Ferrari" isn't just racing against a clock, it’s operating in an environment where safety and stability are never guaranteed.

We will continue to monitor the situation and hope for the safe and immediate return of all those involved.

Sources:

Vizsla Silver Feasibility Study (Nov 2025): Vizsla Silver Delivers Positive Feasibility Study

Vizsla Funding Status (Jan 2026): Vizsla Silver Eyes Panuco Construction

Apollo Silver Resource Update (Oct 2025): Apollo Files NI 43-101 Technical Report

Apollo Silver Strategic Investment (Dec 2025): Apollo Silver Announces $25M Strategic Investment

Disclosure:

At the time of publication, the author holds no position in Vizsla Silver or Apollo Silver but reserves the right to buy or sell these securities at any time. Neither company was contacted or consulted for this article. Artificial intelligence was utilized to assist in the research and drafting of this report.

What did you think of this article?

Let the author know your thoughts

Investment Disclaimer

The information provided in this article is for educational and informational purposes only and should not be construed as financial, investment, or professional advice. You may lose all of your money when investing. All investments carry substantial risk, including the potential for complete loss of principal. Past performance does not guarantee future results. You must conduct your own research and due diligence, including independently verifying all facts, numbers, and details provided in this article. Please consult with a qualified financial advisor before making any investment decisions.